Kent County Library Tax District FAQ

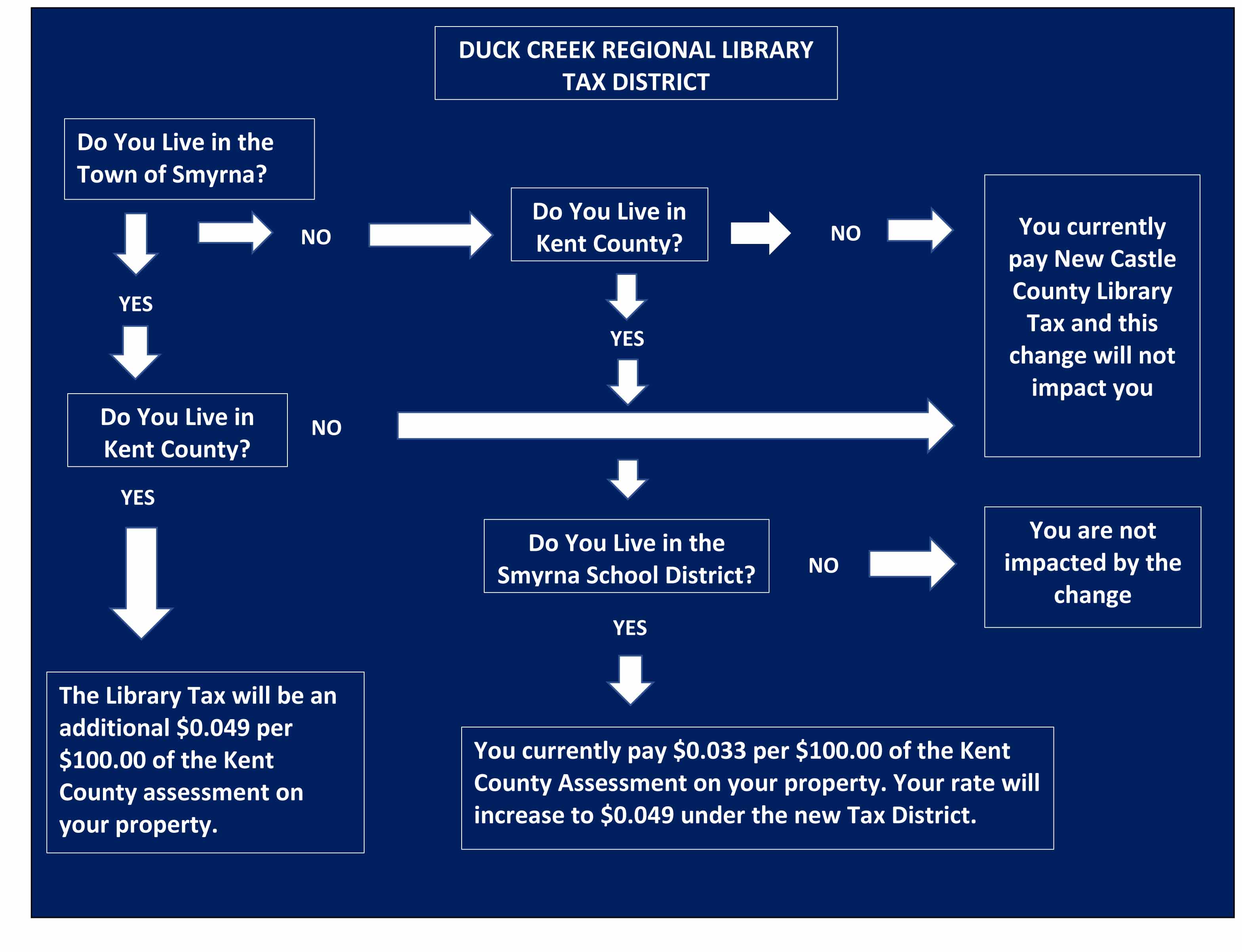

Q. I live in the Town of Smyrna, what will the Library Tax District mean for me?

A. If you live in the Town of Smyrna you currently pay property taxes to the Town of Smyrna, which then partially funds the existing Smyrna Town Library through the general fund. Smyrna residents do not currently pay a Library Tax to Kent County. Under the Library Tax District, your town taxes will no longer fund the Town Library and you will begin paying a library tax to Kent County at a rate of $0.033/$100 of assessed value of your property.

Q. I already pay a Kent County Library Tax because I live outside the Town of Smyrna, what will this new Library Tax District mean for me?

A. If you live in Kent County and the Smyrna School District, but are outside of the Town of Smyrna, you currently pay a Kent County Library Tax of $0.033/$100 of the assessed value of your property. You will see no change.

Q. What happens when we reassessment of county property occurs?

A. When the reassessment is completed the tax rate will be adjusted so that residents do not pay any additional tax.

Q. What is the assessed value of my house? Why is my assessment for the Town of Smyrna different from Kent County? Which assessed value will be used in calculating the Library Tax?

A. The assessed value of a property is a calculation used for tax purposes. This value is not the purchase price or market value of a property. Kent County and the Town of Smyrna use different calculations when they determine the assessed value of a property. The proposed library tax District will use the Kent County assessed value.

Q. I live in the Town of Smyrna, but in New Castle County. What does this mean for me?

A. New Castle County has committed to making an annual contribution to the library for operations.

Q. What will happen to the current Town of Smyrna Library and staff?

A. The current Town of Smyrna Library will be closed when the new Duck Creek Regional Library opens. The building and collections belong to the Town, and the Town will decide what to do with the existing assets. The current library staff will be given the opportunity to apply for jobs at the new library and continue in their current positions or other positions for which they are well suited.